Updated April 9, 2021

The Professional Photographers of Canada recognizes that professional photographers throughout the country have questions about what types of photography shoots they may currently engage in while remaining compliant with any requirements to restrict their business. Because all Canadian Provinces have differing restrictions, which may also vary within provincial regions, PPOC encourages all photographers to check with their local Public Health Units before proceeding. In some areas, restrictions are changing with frequency, so it is important to check often to ensure your safety and the safety of your clients.

Updated June 2, 2020

Health & Safety Guidelines for Commercial Photographers

CAPIC has released recommended Health and Safety Guidelines for Commercial Photographers returning to work during the Covid-19 pandemic. These are guidelines that photographers should adapt to fit their own respective businesses. All photographers following these guidelines must ensure that they are also abiding by all local health and safety directions.

Public Health authorities set the minimum standards and regulations and these must be adhered to by everyone.

Provincial Ministries of Labour require that employers have a comprehensive health and safety plan in place for Covid-19. Photographers must establish their own policies that clearly outline the measures they are implementing to mitigate the spread of Covid-19. The following guidelines are designed to assist commercial photographers in the creation of their Covid-19 Workplace Policy.

Download Health & Safety Guidelines for Commercial Photographers

Updated June 1, 2020

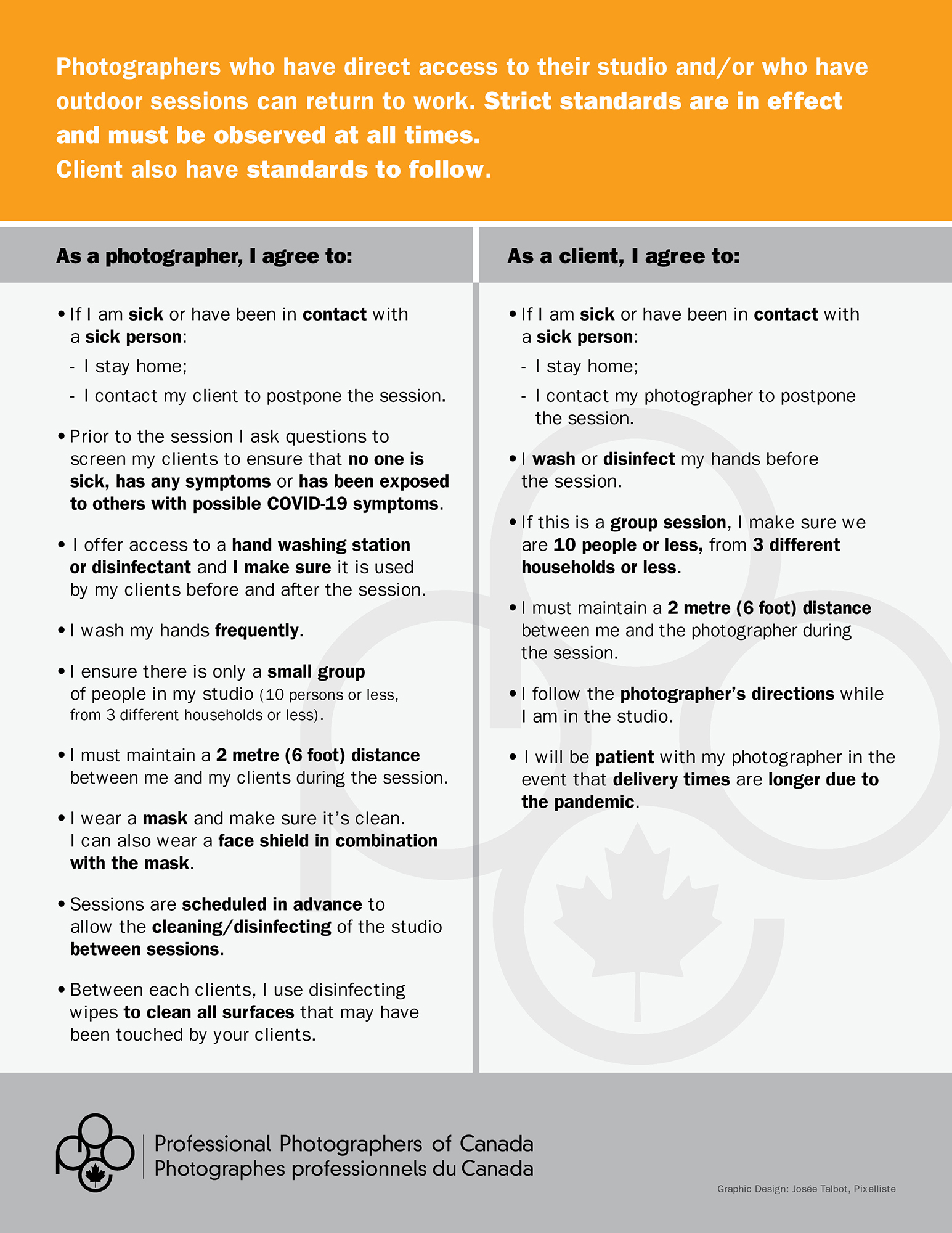

We recognize that not all provinces have yet added photography to their lists of services and businesses that may resume operation. For those who have been green-lighted, we are happy to offer you additional tools to assist in your re-opening. For those yet waiting to re-open, we hope these tools will assist you in your preparations. Please feel free to download and share with your peers.

Updated May 11, 2020

Photography: Returning to Work during COVID-19

Guidelines from the Professional Photographers of Canada (PPOC)

As we come through the Covid-19 pandemic, it will soon become time when we can start to re-open our studios and photography businesses and start to work again. When that happens will vary across the country and it is important that you follow the guidelines and restrictions from Public Health that are in place in your province and region. The pandemic is not over so it will be critical that we do all we can to prevent the further spread of the virus.

The following are some guidelines PPOC has created to help you re-open your business/studio while keeping yourself, your family and your clients as safe as possible. These are guidelines only. Above all, follow the specific restrictions of your local Public Health and government experts. A list of reliable resources is attached for reference. Download Guidelines for Returning to Work

Updated June 29, 2020

The COVID-19 pandemic is having a significant impact on all sectors of the global economy. PPOC recognizes that many photographers are self-employed individuals who will be in need of assistance to maintain operation as the world moves through these challenging times. We have compiled a list of links to information and services that may be of assistance to photographers.

Please feel free to share it widely, and stay well.

MENTAL HEALTH

Canadian Mental Health Association

Government of Canada

World Health Organization (WHO)

FREE ACCESS

- Adobe: Two free months of Creative Cloud (in some cases three months when contacting them via chat)

- Adobe: Free at-home access to Creative Cloud for students during campus closures.

- Affinity: Three months of free access to Affinity Photo, Designer and Publisher.

- PPA: Two weeks of free access to 1,100 classes for everyone worldwide.

- Creative Live: Health & Wellness classes streaming for free.

- Apple: 90-day free trial for Final Cut Pro X

- Algonquin College: Free virtual classrooms until April 30, 2020

- WeTransfer Pro: two free months when reaching out to their customer service.

- Shopify: extended 90-day trial

- Skillshare: 2 free months of unlimited classes

- Moneris: you can ask to temporarily waive rental fees.

EDUCATION

- How to Disinfect Camera Equipment and Spaces

- NPPA COVID-19 Safety Help Sheet

- ASMP Webinar: Potential Business Ramifications of COVID-19

- PPA Webinar: How to Navigate Contract Cancellations

- PhotoCoach: Free resources to manage the crisis.

- General Resources for Artists

FINANCIAL RELIEF

- Home Internet: Roger, Bell and Telus remove data caps for home internet.

- Banks: Up to a 6-month payment deferral for mortgages, Opportunity for relief on other credit products

FEDERAL HELP

- All Federal Measures

- Canada Emergency Response Benefit: payment of $2,000 for a 4-week period (equivalent to $500 a week) for up to 16 weeks. It’s available to workers:

- residing in Canada, who are at least 15 years old;

- who have stopped working because of COVID-19 or are eligible for Employment Insurance regular or sickness benefits;

- who had income of at least $5,000 in 2019 or in the 12 months prior to the date of their application; and

- who stopped working due to COVID-19 and do not expect to receive more than $1,000 (before taxes) from employment and self-employment income.

You can apply online with CRA My Account or over the phone at 1-800-959-2019 or 1-800-959-2041.

- Canada Emergency Wage Subsidy (CEWS): subsidy of 75% of employee wages for up to 12 weeks, retroactive from March 15, 2020, to June 6, 2020.

- Temporary 10% Wage Subsidy: three-month measure that will allow eligible employers to reduce the amount of payroll deduction required to be remitted to the Canada Revenue Agency.

- Tax Filing:

- Individuals have until June 1, 2020, to submit their income tax return.

- Taxpayers have until September 1, 2020 to pay any 2019 income tax amounts owed.

- Companies have until September 1, 2020 to pay tax balance due and instalments.

- Sales Tax: businesses, including self-employed individuals, can defer until June 30, 2020 payments of the GST/HST and customs duties.

- Emergency Care Benefit: up to $900 bi-weekly for up to 15 weeks to provide income support to workers including the self-employed. Apply in April 2020.

- Canada Child Benefit: increased by $300 per child

- Special Goods and Services Tax credit payment: close to $400 for single individuals and close to $600 for couples. If you are eligible, you will get it automatically (no need to apply)

- Employment Insurance:

- Employment Insurance sickness benefits: if you are sick, quarantined or have been directed to self-isolate, medical certificate requirements are waived. Apply here.

- Student Loans: six-month interest-free moratorium on the repayment of Canada Student Loans for all student loan borrowers. No payment will be required, and interest will not accrue during this time.

- Canada Emergency Student Benefit (CESB): This benefit provides $1,250 per month for eligible students or $2,000 per month for eligible students with dependents or disabilities, available from May to August 2020. More details will be made available soon.

- Canada Emergency Business Account (CEBA): interest-free loans of up to $40,000 to small businesses and not-for-profits.

- Business Credit Availability Program (BCAP):

- Canada Emergency Commercial Rent Assistance (CECRA): This program will lower rent by 75 per cent for small businesses that have been affected by COVID-19.

PROVINCIAL HELP

Alberta

- All Alberta Measures

- Support for Employers and Employees

- Corporate income tax: balances and installment payments will be deferred until August 31, 2020.

- Utility payment deferral: residents, agri-businesses and small businesses can defer electricity and natural gas bill payments until June 19 to ensure no one will be cut off, regardless of the service provider.

- Education property tax deferral: the Alberta government has deferred education property tax for businesses for the next six months.

- Workers Compensation Board premium deferral: WCB premiums have been deferred until early 2021. Employers who have already paid their WCB premium payment for 2020 are eligible for a rebate or credit. For small and medium businesses, the government with cover 50% of the premium when it is due.

- Student loans repayment deferral: six-month, interest-free, moratorium on Alberta student loan payments for all Albertans.

- Calgary: If you are struggling to pay your water bill during this time you can contact ENMAX, our contracted billing provider, at 310-2010 to discuss options that are available to you. Water Utility customers will not have their water service disconnected for non-payment during this time.

- Edmonton: No late penalties will be charged to property tax payments made by August 31.

- ATB Financial: Customers can apply for a deferral on their ATB loans, lines of credit, and mortgages for up to six months.

British Columbia

- All British Columbia Measures

- Provincial tax filings: deferred to September 30, 2020 for: Employer Health Tax, Payment of Provincial Sales Tax, Regional District taxes, Carbon tax, Motor fuel tax, Tobacco tax.

- BC Emergency Benefit for Workers: will provide a one-time $1,000 payment to people who lost income because of COVID-19. Online applications for the one-time payment will open May 1, 2020.

- BC Climate Action Tax Credit: A one-time enhancement to the climate action tax credit will be paid in July 2020 for moderate to low-income families: an adult will receive up to $218.00 (increased from $174.00), a child will receive $64.00 (increased from $51.00)

- BC Temporary Rental Supplement Program: will provide up to $500 per month paid directly to landlords. The program will be accepting applications in mid-April.

- Eviction Suspension: BC Housing has temporarily suspended evictions of tenants in subsidized and affordable housing due to non-payment of rent.

- C. Student Loans: Starting March 30, 2020, B.C. student loan payments are automatically frozen for six months.

- BC Hydro:

- Customers can defer bill payments or arrange for flexible payment plans with no penalty through the COVID-19 Customer Assistance Program.

- Customers experiencing job loss, illness or lost wages due to COVID-19 can access grants up to $600 to pay their hydro bills through the Customer Crisis Fund.

- ICBC: Customers on a monthly payment plan who are facing financial challenges due to COVID-19 may defer their payment for up to 90 days with no penalty.

- FortisBC: Residential FortisBC customers can sign up for the COVID-19 Customer Recovery Fund to automatically have their bills deferred from April 1 to June 30, 2020.

Manitoba

- Manitoba Business Resources

- Manitoba Gap Protection Program: To help small businesses who are not eligible for federal programs, with $6,000 in immediate provincial support.

- Manitoba Summer Student Recovery Jobs Plan: To encourage the hiring of summer students with 50/50 in matching wages, totaling $5,000 in funding for up to 5 students per organization.

- Tax Filing: Manitoba Government extends tax payment filing deadline for businesses by two months

- RST Filing: monthly RST remittances of no more than $10,000 per month that would normally be due on April 20th and May 20th will now be due on June 20, 2020.

- HE Levy: monthly HE Levy remittances of no more than $10,000 per month that would normally be due on April 15th and May 15th will now be due on June 15, 2020.

- Utilities: no interest or penalties for Manitoba Hydro, Centra Gas, Workers Compensation Board and Manitoba Public Insurance (MPI). Customers of Manitoba Hydro and Centra Gas won’t be disconnected

- Education Property Taxes: no interest charged.

New Brunswick

- Business resources

- Workers Emergency Income Benefit: one-time income benefit of $900 available for workers or self-employed people residing in New Brunswick who have lost their job due to the state of emergency.

- WorksafeNB: deferred premium payments for 3 months.

- Child care: The Government of New Brunswick has committed to covering the child-care fees of anyone who has lost their income due to the ongoing COVID-19 outbreak.

- Property Taxes: late penalties will be reviewed on a case-by-case basis to see if the penalty can be waived due to COVID-19.

- Provincial Loans: loan and interest repayments deferred for up to six months on existing provincial loans, on a case-by-case basis. Businesses can request deferrals by contacting the department that issued the loan.

- NB Small Business Emergency Working Capital Program: working capital loans up to $100,000 for small businesses, no interest/principal payments for 6 months

- Opportunities New Brunswick Working Capital Loans: Working capital in excess of $100,000, up to a maximum of $1 million is available.

- NB Power: NB Power will defer electricity bill payments for residential and small business customers for up to 90 days for impacted customers.

Newfoundland & Labrador

- General COVID-19 resources

- Business Loans: Loan payments on business loans administered by the Innovation and Business Investment Corporation are deferred by three months.

- WorkplaceNL: workers' compensation premium payment deferral until June 30, 2020.

Nova Scotia

- All Nova Scotia Measures

- Worker Emergency Bridge Fund: one-time payment of $1,000 for Nova Scotians who are laid off or out of work because of COVID-19, who don’t qualify for Employment Insurance, and earn between $5,000 and $34,000.

- Government Loans: Government will defer payments until June 30 for all government loans.

- Government Fees: many program and service fees are deferred until June 30.

- Small Business Loan Guarantee Program: principal and interest payments are deferred until June 30, businesses get easier access to credit up to $500,000, and the government will guarantee the first $100,000.

- Workers’ Compensation: premiums are being deferred until July 2020.

- Income Assistance: Every individual and family member on income assistance will receive an additional $50 starting Friday, 20 March. People do not need to apply.

- Student Loans: payments on Nova Scotia student loans are deferred until September 30th.

- Government Payments: Small businesses which do business with the government will be paid within five days instead of the standard 30 days.

- Virtual School Meal Pilot Program: provides nutritious meals to students who relied on school meal programs while schools are closed due to COVID-19.

- Residential tenancy protection: If your income has been affected by COVID-19 and you’re unable to pay your rent, you can’t be evicted until 30 June 2020.

Ontario

- Ontario Measures for Businesses

- Child Benefit: one-time payment of $200 per child up to 12 years of age, and $250 for those with special needs, including children enrolled in private schools.

- Guaranteed Annual Income System: double the GAINS payment for low-income seniors for six months

- Electricity: setting electricity prices for residential, farm and small business time-of-use customers at the lowest rate, known as the off-peak price, 24 hours a day for 45 days

- Low-income Energy Assistance Program: expanding eligibility for LEAP and ensuring that their electricity and natural gas services are not disconnected for nonpayment.

- Student Loans: six months of Ontario Student Assistance Program (OSAP) loan and interest accrual relief for students.

- Provincial Business Taxes: five months of interest and penalty relief for businesses to file and make payments for the majority of provincially administered taxes.

- WSIB: payments deferred for up to six months

- Education property tax: June 30 payments are deferred 30 days.

- Support for employers: employers have the option to temporarily lay off employees for up to 13 weeks. After 13 weeks, the lay off becomes permanent and severance pay rules will apply.

- Support for employees: employers are restricted from asking for doctor’s notes for COVID-19 related leaves, including quarantine, self-isolation or childcare responsibilities due to COVID-19 related school and daycare closures.

- Toronto: 60-day grace period on City of Toronto property tax, Toronto Water, and Solid Waste bill payments, as of March 16, 2020. Additionally, late payment penalties on business properties will be waived for 60 days, starting on March 16, 2020.

- Toronto Arts Council COVID Response Fund: up to $1000 to self-employed, individual artists resident in Toronto whose creative work and income have been affected by the COVID-19 pandemic. Apply by April 30, 2020.

Prince Edward Island

- All business resources:

- Worker Assistance Program: Financial support to employers providing a maximum of $250 per week for each employed worker that experienced a reduction of at least 8 hours per week during the two week period March 16-29, 2020.

- Income Support Fund: one-time lump sum payment of $750 (taxable) to bridge the gap between the loss of their job/lay-off, loss of their primary source of income, Employment Insurance benefits have expired or loss of all revenues through self-employment as a result of COVID-19.

- Emergency Income Relief for the Self-Employed: The Emergency Income Relief Fund is a temporary program put in place to support the self-employed who have been significantly affected by COVID-19.

- Emergency Working Capital Financing: Program to help small businesses maintain normal business operations. Each qualified company is eligible to receive up $100,000.

- Government Loans: scheduled loan payments are deferred for the next 3 months for clients of Finance PEI, Island Investment Development Inc., and the PEI Century Fund.

- Support for Employees: a temporary allowance of $200 per week for anyone who has experienced a significant drop in their working hours.

- Student Loans: repayments for provincial student loans deferred for the next six months.

- Employee Gift Card Program: $100 Sobeys gift card to any employee, living and working on Prince Edward Island, who has received a lay-off notice as a direct result of the impacts associated with COVID-19.

- Commercial Lease Rent Deferral Program: landlords are encouraged to defer rent payments from their commercial tenants for 3 months, spreading the deferred rent amount over the rest of the lease term. If your tenant’s business is closed due to the Health Protection Act order, you could be eligible for coverage (up to a maximum of $50,000 per landlord and $15,000 per tenant) if you can’t recover the deferred rent. Landlords must register with Finance PEI by April 20, 2020 by emailing financepei@gov.pe.ca

- Property Tax Relief:

- provincial property tax and fee payments are deferred until December 31, 2020;

- property assessment appeal deadlines for assessment year 2020 are extended to December 31, 2020;

- interest relief for tax year 2020, including all past due amounts;

- tax sale processes are suspended for the remainder of 2020; and

- provincial tax bills for 2020 are delayed until June.

Québec

- All Quebec Measures

- Emergency Help for Small Businesses: loan or loan guarantee of up to $50,000

- Concerted temporary action program for businesses: loans in excess of $50,000

- Government Assistance Programs: online tool determine what type of assistance is available in your situation.

- Government financial support programs for businesses: online tool to determine the type of assistance best suited to your situation.

- Taxes:

- The deadline for individuals for filing provincial income tax returns is postponed to June 1, 2020.

- For individuals and individuals in business, the deadline for 2019 balances due is postponed to September 1, 2020.

- The deadline for 2020 instalment payments for is postponed to September 1, 2020.

- The deadline for businesses to pay tax instalments and taxes due between March 18, 2020, and September 1, 2020, is suspended until September 1, 2020.

- Insurance: The deadline for 2019 Québec Pension Plan, Québec Parental Insurance Plan, Health Service Fund, and Québec drug insurance plan contributions is postponed to September 1, 2020.

- Student Loans: student loan debt repayments are postponed for 6 months.

- Fonds local d’investissement: three-month moratorium for the repayment (principal and interest) of loans already granted through the FLI.

- Hydro-Québec: starting March 23, 2020, it will suspend the application of charges for unpaid invoices for all its customers (individuals and businesses) until further notice.

- Montréal: Property tax deadline is postponed from June 1, 2020, to July 2, 2020:

- Québec: the May 4, 2020, municipal tax payment has been postponed to August 4, 2020; the July 3, 2020, municipal tax payment has been postponed to September 3, 2020; and the September 3, 2020, municipal tax payment has been postponed to November 3, 2020.

- Other cities: municipal taxes also postponed in Laval, Longueil, Lévis, Trois-Rivières, Gatineau, Granby and Saint-Bruno-de-Montarville.

Saskatchewan

- All Saskatchewan Measures

- Self-Isolation Support Program: $450 per week, for a maximum of two weeks for Saskatchewan workers forced to self- isolate in order to curb the spread of COVID-19, and who are not covered by recent federally announced employment insurance programs and other supports.

- Saskatchewan Small Business Emergency Payment (SSBEP): payment to small and medium-sized enterprises directly affected by government public heath orders related to COVID-19, based on 15 per cent of a business's monthly sales revenue, to a maximum of $5,000. Extended to the month of May.

- Penalty and Interest Waiver for Businesses: Businesses directly impacted by COVID-19 and that are unable to file their provincial sales tax returns by the due date may submit a request for relief from interest or penalties.

- PST: Three Month PST Remittance Deferral and Audit Suspension

- Crown Utility Interest Deferral Programs:zero-interest bill deferral for up to six months for Saskatchewan customers whose ability to make bill payments may be impacted by the COVID-19 restrictions.

- Self-Isolation Support Program: will provide $450 per week for a maximum of two weeks (or $900) for residents who are forced to self-isolate.

- Student Loans Repayment Deferral: six-month, interest free moratorium on Saskatchewan student loan payments.

- Workers' Compensation Board: premium penalties waved for employers effective April 1 until June 30, 2020.

Northwest Territories

- All NWT Business Resources

- BDIC Loans: current loan payments can be reduced or deferred without penalty or additional interest charges for up to 3 months.

- BDIC Working Capital Loans: loans of up to $25,000 are available to NWT businesses at a rate of 1.75% through BDIC.

Yukon

- All Yukon Measures

- Yukon Business Relief Program: Eligible Yukon businesses will receive between 75 and 100 per cent of their fixed costs up to a maximum of $30,000 per month.

- Special funding available for arts initiatives: special funding for arts-related initiatives relating to specific themes. Applicants may apply to receive up to $2500 for individuals, or $5000 for businesses, not-for-profit organizations and collectives.

- Yukon Workers’ Compensation Health and Safety Board: assessment premiums can be deferred without penalty or interest charges to a date that is appropriate for an employer’s business situation.

- Paid sick leave rebate for employers: A maximum total of 10 days of wages per employee to allow for sick leave and/or for a 14-day self-isolation period

- Events grant: to cover irretrievable losses related to perishable goods and cancellation of accommodation and services as a result of major events cancelled due to this developing situation.

Updated March 26, 2020

The Government and public health officials are urging all Canadians to:

- stay home unless it is absolutely essential to go out

- practice social distancing and good hygiene

What does Social or Physical Distancing mean?

This means making changes in your everyday routines in order to minimize close contact with others, including:

- avoiding crowded places and non-essential gatherings

- avoiding common greetings, such as handshakes

- limiting contact with people at higher risk (e.g. older adults and those in poor health)

- keeping a distance of at least 2 arms lengths (approximately 2 metres) from others, as much as possible

For these reasons, PPOC recommends canceling or postponing all photography sessions involving people, as well as any photography assignments not in accordance with federal and provincial regulations.

We realize some sessions such as newborn or maternity are time-sensitive. At this time we recommend these be canceled to avoid any risk whatsoever of transferring COVID-19 to your clients.

COVID-19 is a silent, invisible, highly communicable disease that can be easily spread days before you would even have a single symptom. We cannot take any chances at critical this time.

We all have to do our part, as difficult as it is, to stop the spread of this deadly virus and flatten the curve to avoid overwhelming our healthcare system and saving lives in the process.

We will get through this. Now is not the time to be around any other people for any reason.